The New Growth Agenda

Introduction

We are on the cusp of a new economic era: One that is driven by the interaction between rapid technological change, sustainable infrastructure investment and increased resource productivity. This new growth story draws direction from the ambitious landmark international agreements of 2015 and 2016,1 embodied particularly in the Sustainable Development Goals (SDGs) and the Paris Agreement, each signed by over 190 countries. These agreements aim to deliver strong, sustainable, balanced and inclusive growth, to reduce global poverty and to secure a better and more sustainable future for people and the planet for decades to come.

The new growth agenda recognizes that the objectives of growth, climate action and development are interrelated and complementary. This complementarity resonates not only with the goals of the agreements themselves but also the policies and investments that can deliver on them. Its main drivers are investment at scale in sustainable infrastructure, innovation and discoveries that push at the frontiers of what is possible, and resource productivity with a particular emphasis on conserving natural capital. This is an agenda which will boost shorter-run growth from increased investment in the low-carbon transition; spur innovation, creativity and growth in the medium term; and in the longer-term, provides the only feasible growth path on offer.

The pioneering 2014 Global Commission report, Better Growth, Better Climate, made the seminal case that there was no trade-off between growth and strong climate action. Following this, the 2016 Global Commission report, The Sustainable Infrastructure Imperative, highlighted the central role of sustainable infrastructure in this new global agenda, in driving strong and inclusive growth, delivering on the SDGs and providing a pathway to meet the ambition of the Paris Agreement to limit global warming to well below 2°C and foster climate resilience. The US$90 trillion investment in infrastructure that is needed by 2030 would not cost much more if it was sustainable and, in fact, because of the falling costs of clean solutions it could deliver savings instead.

The opportunities offered in this new growth agenda are even greater than they appeared four years ago. Technological advances and falling costs of renewable energy have made sustainable investments even more attractive, to the point that many are now more cost competitive than traditional fossil fuel-based technologies. The world now adds more renewable power capacity annually than from all fossil fuels combined.2 The co-benefits of investing in sustainable infrastructure are increasingly evident: cities where we can move, breathe and be productive; resilient power and water systems and housing that withstand increasingly frequent and severe climate extremes; and ecosystems that are more productive, robust, and resilient. Discourse has shifted from the costs of inaction to how to exploit emerging opportunities in this new economy. Also increasingly evident is that such a path avoids the costs of high-carbon development, including remedial measures that become progressively costlier over time. The new climate economy is the new growth story.

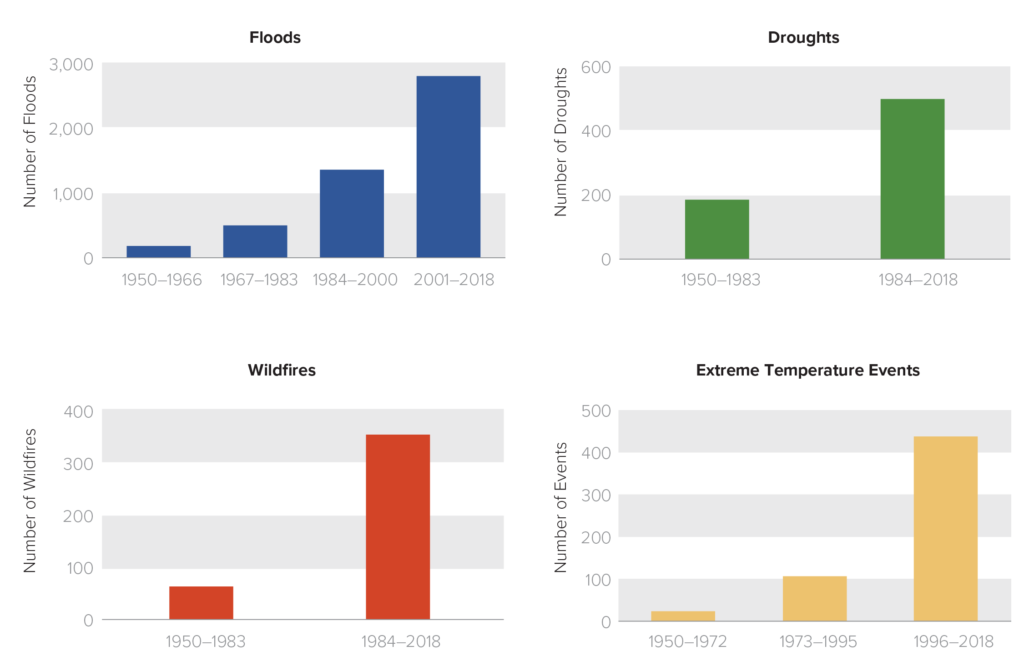

Risks and costs of inaction are mounting faster and are greater than previously recognised. 2017 was the second hottest year globally since 1880 when modern record-keeping began,3 reflecting a broader trend with 18 of the 19 warmest years occurring since 2000.4 Concentrations of GHGs continue to reach new records and are now at the highest level in millennia.5 More frequent and more intense extreme weather events are becoming the ‘new normal’ (see Figure 1). Globally, disasters triggered by weather-related hazards caused as much as US$320 billion in losses in 2017, significantly higher than average, as well as thousands of deaths.6 Forecasts from climate scientists are now observed or even exceeded, including accelerating sea-level rise, Arctic summer melt, ocean circulation disruption, and increasing extreme weather events, such as floods, droughts and heatwaves. Planetary boundaries are under severe threat not just from carbon emissions, but from polluted air, threats to fresh water and oceans, degradation of agricultural land and natural landscapes, and loss of biodiversity and ecosystems.7

A changing climate will also particularly impact the poorest and most vulnerable. Business-as-usual growth could mean over 140 million climate migrants by 2050, according to the World Bank.8 While much of the movement may be internal, this is still more than double the total number of all refugees today and will further exacerbate the likelihood of conflict. Adverse health outcomes could also increase under unabated climate change, due to more intense heatwaves, floods, droughts, a greater risk of food and water-borne diseases, and more rapid spread of pathogens.9 Outdoor air pollution, largely from fossil fuel combustion, is estimated to result in over 4.2 million premature deaths annually.10

If we are to limit the worst effects of a changing climate by keeping to a path consistent with the goals of the Paris Agreement, global GHG emissions will need to get to net-zero emissions in the second half of this century.11 As the forthcoming report of the Intergovernmental Panel on Climate Change (IPCC) will show, urgent action is needed now to keep global average temperature rise to well below 2oC and pursue efforts to limit it to 1.5oC, as countries committed to do through the Paris Agreement. It is also already clear that there is a significant gap between the national commitments (Nationally Determined Contributions or NDCs) made and the emissions reductions needed.12 Three years on from the Paris Agreement, very few countries have adopted plans to sufficiently reduce emissions.

The 2018 Report of the Global Commission on the Economy and Climate

The 2018 Report of the Global Commission on the Economy and Climate