Section one | The Sustainable Infrastructure Opportunity

Introduction

The year 2015 was a landmark one for sustainable development and climate change.

The world set ambitious goals through the Addis Conference on Financing for Development in July 2015, the adoption of the 2030 Agenda and the Sustainable Development Goals (SDGs) in September, and by reaching a landmark international agreement on climate action at COP21 in Paris in December. This new global agenda has mobilised the support not only of national leaders, but also of mayors, business leaders, investors, civil society and citizens. Now the task is to quickly turn that momentum into on-the-ground action to implement the Paris Agreement, achieve the SDGs, and reignite global economic growth.

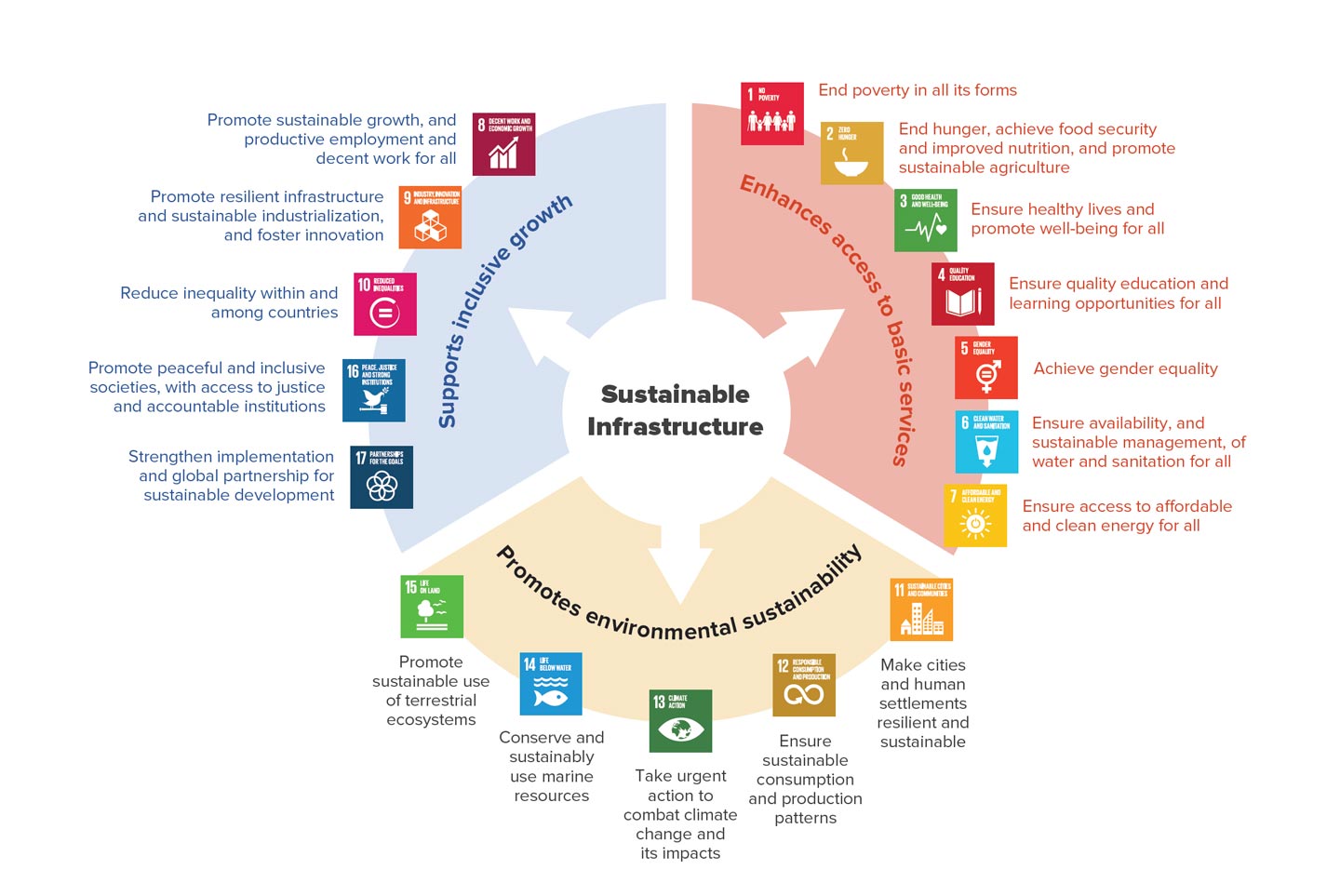

Sustainable infrastructure is crucial to all three goals. Investing in it can support inclusive growth, enhance access to basic services that can reduce poverty and accelerate development, and promote environmental sustainability.

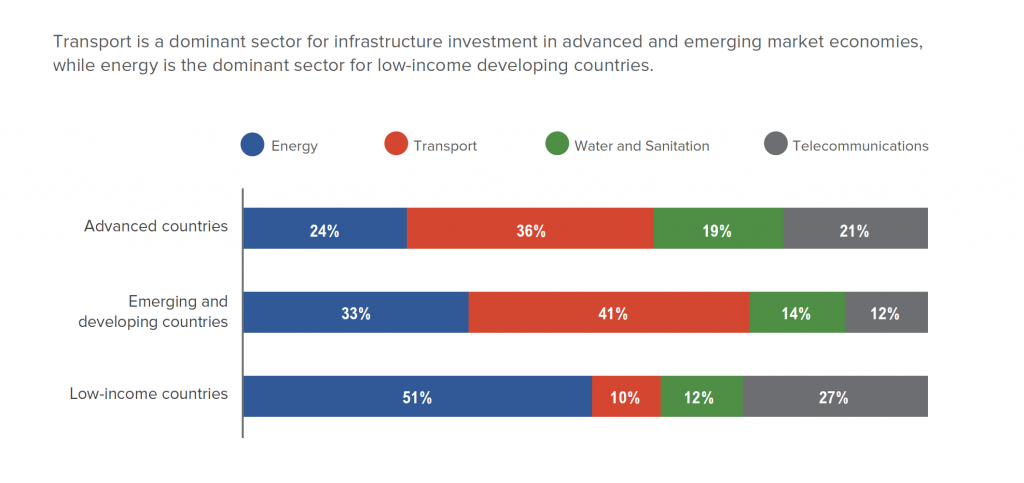

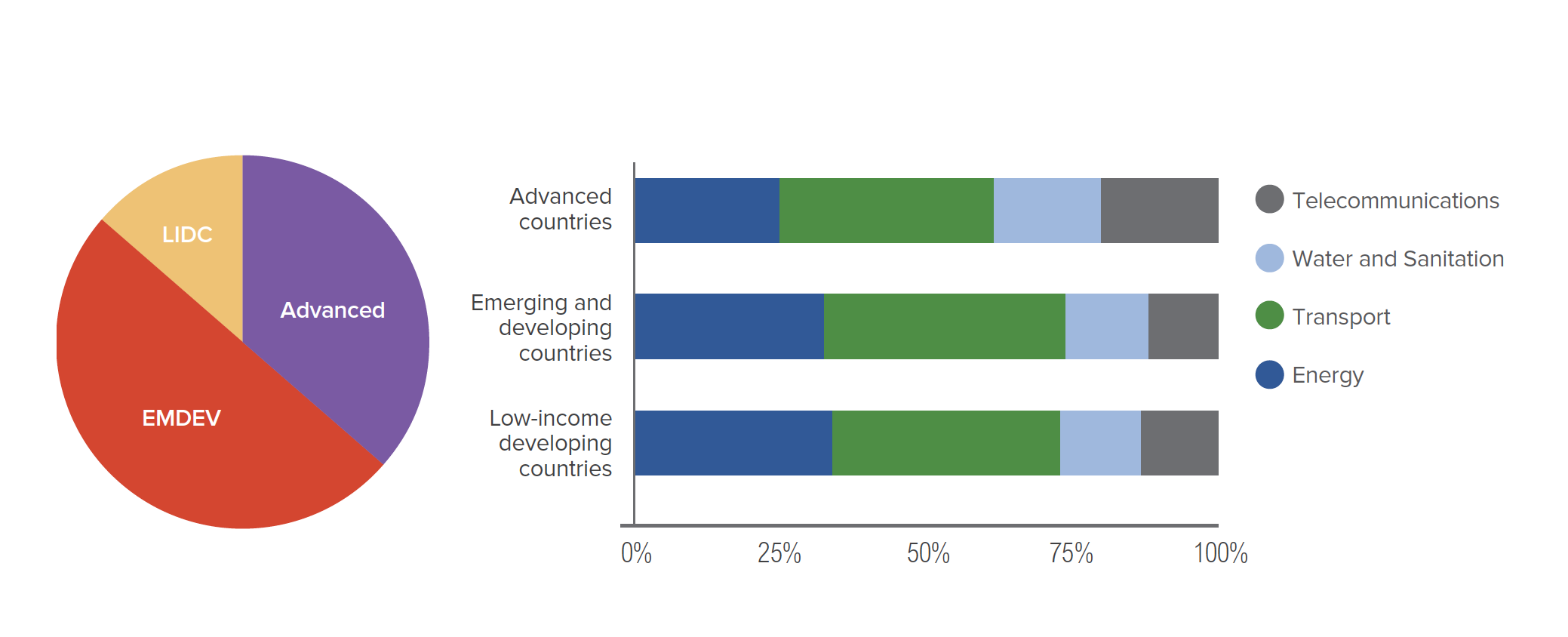

For growth: Boosting investment in sustainable infrastructure can stimulate demand at a time when many economies are struggling. The International Monetary Fund (IMF) estimates that for advanced economies, investing an extra 1% of GDP in infrastructure will yield, on average, a 1.5% increase in GDP within four years.1 In emerging and developing economies, where infrastructure is often inadequate, the benefits for productivity and growth can be even greater, particularly if the investments are accompanied by reforms that increase institutional capacity for better planning and stronger budget processes and rules to guide public spending.2 Beyond the immediate boost to growth, investment in sustainable infrastructure can spur innovation and efficiency in key systems such as energy, mobility and logistics. Since the economic and financial crisis that started in 2008, governments have responded with a number of monetary, fiscal and structural policy reforms to boost growth. While important, these have not yet fully delivered the scale and quality of growth desired. The divide between the poorest and the wealthiest continues to grow in many countries, and large gaps persist in basic infrastructure and related services in a number of countries. Awareness is rising of the role that boosting investment in sustainable infrastructure can play to complement and bolster other reforms to deliver better long-term, sustainable and inclusive growth. The pace of action must be accelerated to realise these opportunities.

For inclusive development: Infrastructure is key to the delivery of a number of essential services. It provides a foundation for much of the SDGs’ vision for inclusive development. Infrastructure is directly addressed in SDG 9, which calls for resilient infrastructure and sustainable industrialisation. It is key to achieving multiple other goals, such as SDG 6, for instance, on clean water and sanitation and SDG 7 on affordable, reliable, sustainable and modern energy for all. Those basic components, in turn, make it possible to achieve SDG 8 on sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all. Sustainable infrastructure is also central to SDG 11 on safe, resilient and sustainable cities. And natural infrastructure is crucial to SDG 2 on ending hunger and to SDG 15 on protecting forests and biodiversity and combatting desertification.

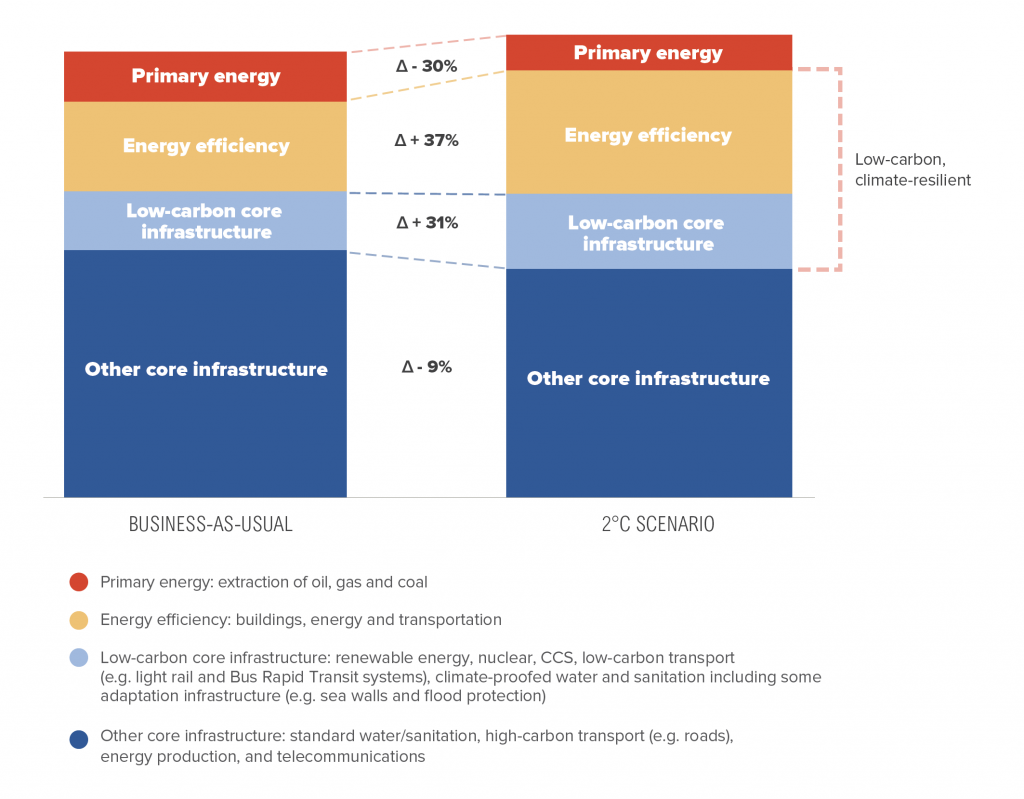

For the climate: Infrastructure underpins all the major sources of greenhouse gas emissions: our energy systems, transport systems, buildings, industrial operations and land use. The existing stock of infrastructure and its use are associated with more than 60% of the world’s total greenhouse gas (GHG) emissions.3 The types of infrastructure we build – coal power plants vs. wind farms and solar arrays, for example, or mega-highways vs. public transit systems – will determine whether we stay on a high-carbon growth path or move towards a climate-smart future. Investing in sustainable infrastructure is thus critical to achieving SDG 13 on combating change climate and its impacts. Not only will it determine GHG emission levels, but it is crucial for resilience: infrastructure can help us withstand climate change impacts and extreme events, or it can increase vulnerability, particularly for the poor.4 Countries that are still building much of their basic infrastructure, such as in much of Africa and parts of Asia, have a major opportunity to build climate-smart from the outset, often at no or little additional cost, and avoid costly retrofitting later. They have an opportunity to lead the way on green development, leapfrogging some of the inefficient infrastructure developments that are now proving costly in other countries.

Growth, development and climate action are inextricably tied. Development is impossible without growth, and growth is pointless unless it lifts up the poorest. Climate change threatens both growth and development. If we don’t take ambitious action now, it is estimated that up to 720 million people could fall back into poverty by 20505and the costs of adaptation could reach US$500 billion dollars per year, unravelling development gains to date.6The future impacts of climate change on poverty relate to today’s policy choices.7World Bank research shows that rapid, inclusive and climate-informed development, including sustainable infrastructure, can prevent most short-term impacts whereas immediate pro-poor, emissions-reduction policies can drastically limit long-term consequences.

Infrastructure can be the pillar upon which we base our growth, development and climate action, or it can crumble beneath us. If we want a prosperous, climate-resilient future, we must invest in sustainable infrastructure; it is the growth story of the future.

The Sustainable Infrastructure Imperative

The Sustainable Infrastructure Imperative